Investment bank Cowen is expecting Apple to report June quarter earnings in-line with the larger Wall Street consensus, and adds that Services and the upcoming 5G “iPhone 12” will boost the company’s momentum going forward.

In a note to investors seen by AppleInsider, analyst Krish Sankar says that Apple’s strong position stems from the upcoming “iPhone 12” cycle as a catalyst for 2021 earnings; the fact that the Services segment is remaining resilient compared to hardware products; and the company’s free cash flow remaining “robust” during coronavirus.

Apple is set to hold its third quarter earnings report and call with investors at 2 p.m. Pacific (5 p.m. Eastern) on Thursday, July 30.

Although the analyst said that Apple may choose not to provide guidance for the September quarter, owning Apple stock is really about the “long-term Services growth opportunity and upcoming 5G iPhone cycle.”

Credit: Cowen

“The Services segment remains a bright spot, and Mac demand could see momentum into the back-to-school period,” Sankar wrote. The analyst is expecting Apple to report sales growth of 23% from the previous quarter and a total of 40 million iPhone units shipped.

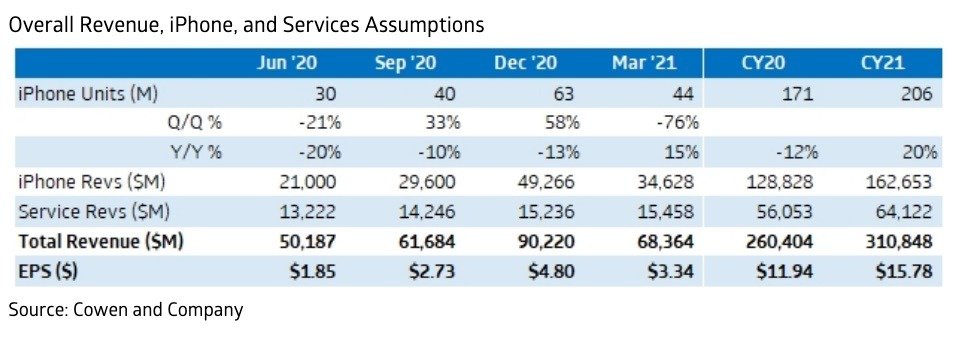

For the quarter overall, the analyst forecasts revenue of $50.18 billion, with $13.2 billion in Services revenue and $21 billion in iPhone earnings, roughly in line with the Wall Street consensus. On average, analysts tracking Apple sales expect the company to report $51.47 billion in this call. That compares to $58.3 billion in the second fiscal quarter of 2020, although traditionally Apple’s third fiscal quarter is the company’s weakest time in the year.

Cowen says that Apple has about $93 billion remaining in its current share repurchase program. Sankar expects buybacks to trend at $10 billion a quarter for the rest of 2020.

Sankar’s forecast claims that iPhone shipments will decline 12% year-over-year in 2020. But, given the expected strength of the “iPhone 12” and 5G, Sankar believes that fiscal year 2021 will see a 20% increase over the 2020 sales numbers.

Cowen’s 12-month AAPL price target remains unchanged at $400, which was upped from $335 in June. That target was based on a blended 25x multiple and a $15.78 earnings-per-share rating for 2021.

Shares of AAPL were trading at $377.18 on the NASDAQ Monday morning, up 1.83% in intra-day trading. Since the start of July, Apple’s stock price is up a total of 3.64%.

Be the first to comment