Apple CEO Tim Cook [left], CFO Kevan Parekh [right]

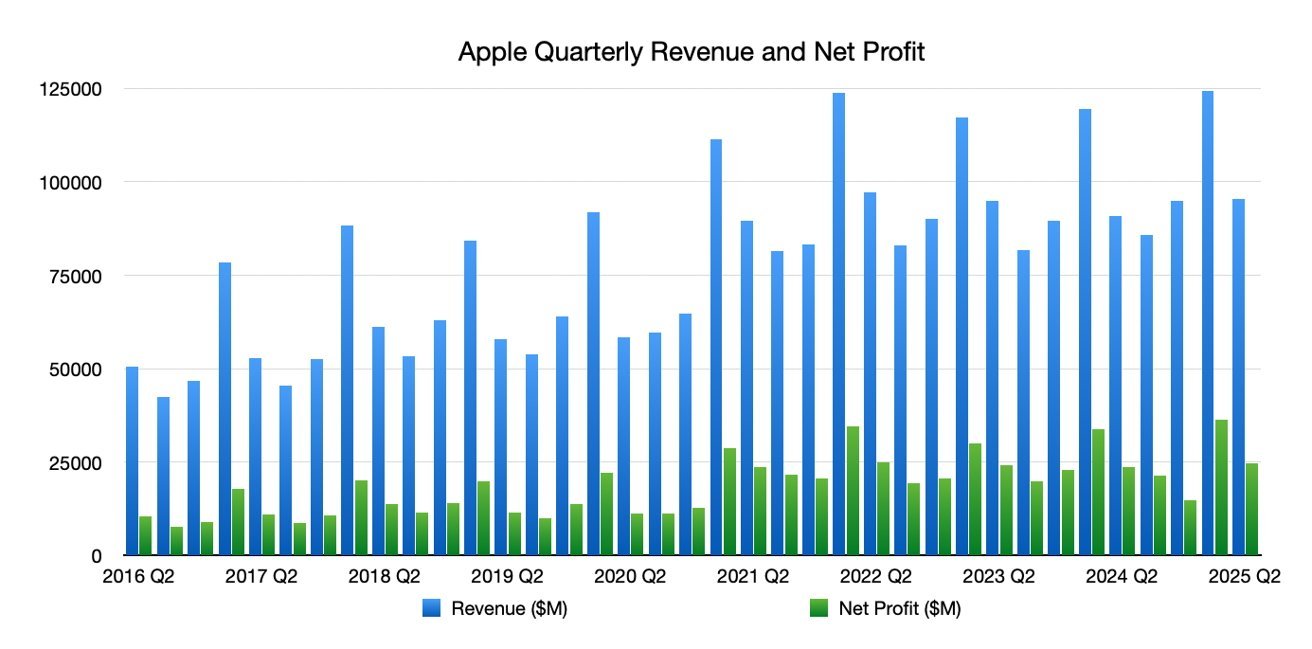

Apple has released its fiscal results for Q2 2025, reporting earnings of $95.4 billion. This marks a modest benefit from consumer tariff concerns, albeit not as significant as anticipated.

Typically, Q2 revenue is lower following a strong Q1 boosted by holiday sales. Nevertheless, these figures remain crucial given Apple’s size and market presence.

In Q2, Apple’s revenue increased by 5% year-over-year from $90.75 billion in Q2 2024, surpassing Wall Street’s expectation of $94.42 billion.

Apple’s quarterly revenue and net profit as of Q2 2025.

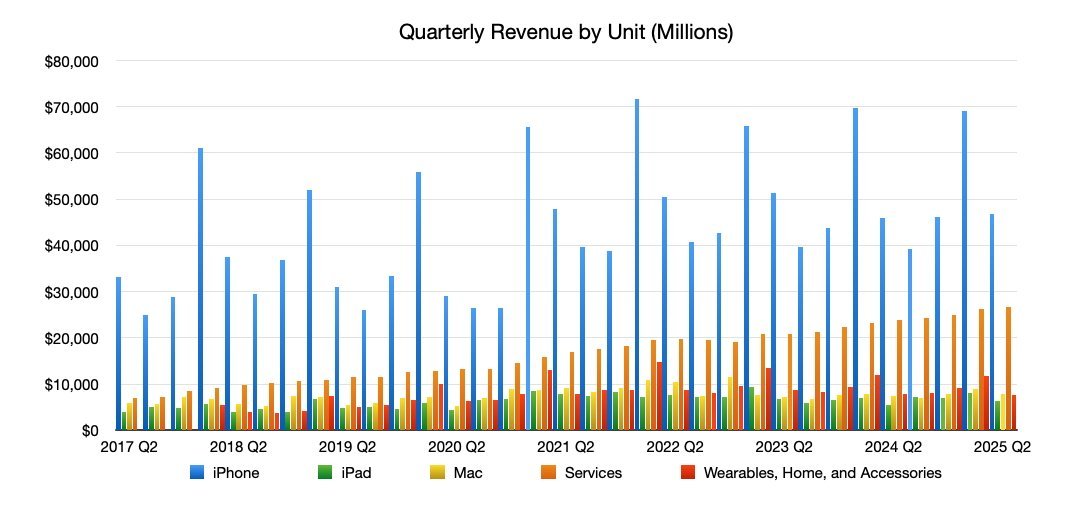

iPhone revenue reached $46.84 billion, up from $45.96 billion a year ago. Mac revenues also rose slightly to $7.95 billion from $7.45 billion.

iPad revenue climbed to $6.4 billion, up from $5.56 billion, while Wearables, Home, and Accessories saw a decrease to $7.5 billion, down from $7.9 billion. The Services segment continued its growth trajectory, generating $26.6 billion compared to $23.9 billion in Q2 2024.

The board of directors has declared a cash dividend of $0.26 per share, with Earnings Per Share reported at $1.65.

Quarterly revenue by unit as of Q2 2025.

During the quarter, Apple enjoyed continued momentum from fall product launches, including the iPhone 16 range.

New product introductions, like the iPhone 16e and the 11th-gen iPad, had limited immediate financial impact as they were not available for the entire quarter.

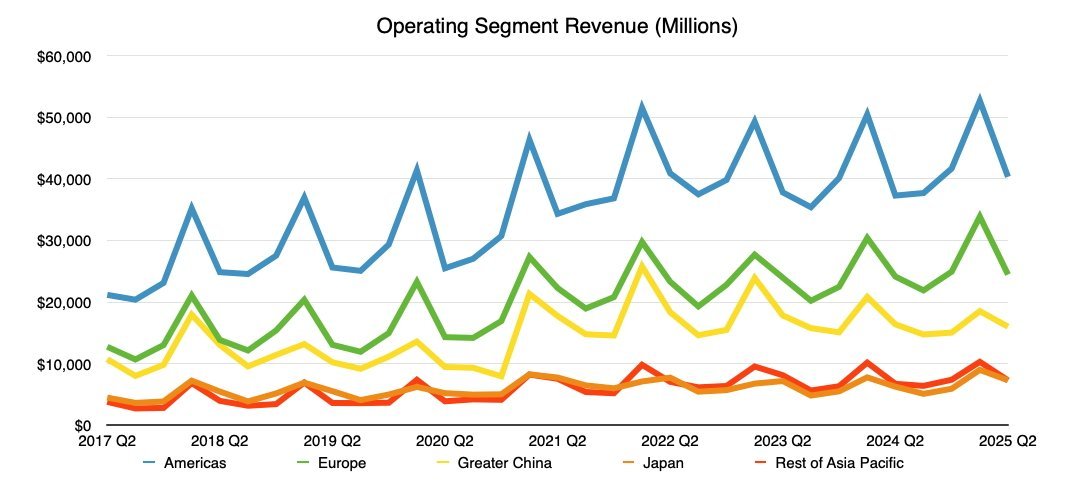

These results come amidst ongoing tariff disputes, particularly affecting China, though Apple has received some reprieve for semiconductor-based products.

Quarterly revenue by operating segment as of Q2 2025.

While the tariffs did not impact Q2 results directly, they are likely to affect the upcoming Q3 2025.

Following the earnings release, Apple’s share price fell almost $5 within 14 minutes of the announcement, a typical market reaction even amidst strong results.

CEO Tim Cook noted the double-digit growth in Services, highlighting that Apple has reduced carbon emissions by 60% in the past decade.

CFO Kevan Parekh remarked on the 8% increase in EPS and $24 billion in operating cash flow, which enables Apple to return $29 billion to shareholders. He emphasized the company’s strong customer loyalty and satisfaction, as well as a new record high in its install base across all product categories and regions.